The Rise of Cryptocurrency

As cryptocurrency is experiencing a worldwide boom, some people have chosen to become active participants, while others merely ignore the system. Cryptocurrency is a new system which is expected to encourage a hyperconnected society by eliminating the middleman and making machine-to-machine trading possible. Clearly, there are both positive and negative sides; cryptocurency could make it easier to trade but risks being used to commit crimes. In this sense, the citizens must be educated about both the pros and cons, so that an informed decision on whether to use the system or not can be made.

What is Cryptocurrency?

A blockchain, the basis of cryptocurrency, is based on the Peer-to- Peer (P2P) system. It means that every trade is coded and linked through a block, just like a chain. Also, it allows every trade between the parties to be visible to everyone. The list of records continuously grows, and it cannot be modified without altering all the recent information that was linked, enabling it to be resistant to hacking.

Cryptocurrency, which utilizes the aforementioned blockchain technology, is a digital asset designed to work between financial exchanges, with cryptography being used to secure, control, and verify the transfer of assets. Cryptography, in this sense, refers to constructing and analyzing protocols that prevent third parties or the public from reading private messages.

There are countless different types of cryptocurrencies worldwide, with the more famous ones being Bitcoin, Ethereum and Ripple. Bitcoin is a literal compound word that refers to “bit” (the basis of information in computer system) and “coin” (money). This cryptocurrency allows people to exchange money without any central figure, and to complete their transactions anonymously. Bitcoin users use the word “mining” to mean “making Bitcoins”, causing people who do this to be known as “miners”. To gain Bitcoins, people can either mine them, or easily buy them through the different markets that sell them. However, the supply is severely restricted, which is the cause of the rise and fall in the value of Bitcoin. On the other hand, Ethereum is not just another type of cryptocurrency, but rather is also a platform and a program that allows people to make an application based on blockchain technology. It has increased in popularity because it supplements the downsides of Bitcoin. It aims to decentralize all trade, by not being limited to decentralizing remittance and payment, like Bitcoin. Lastly, Ripple, which started in 2004 with the name RipplePay, was first developed as a service to send money to different countries all over the world. Unlike other cryptocurrencies, however, Ripple does not utilize the method of mining.

The Pros of Cryptocurrency

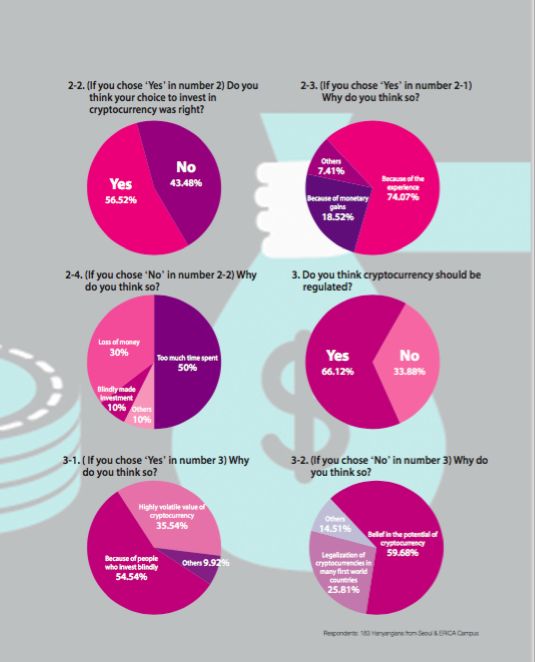

According to Choi Moon- kyoung, a student from the Department of Mechanical Engineering, he chose to invest in cryptocurrencies because he was sure that it would be an experience that would matter. “Even though I invested a good amount of money and lost it, I gained more than what I actually lost. I was able to develop an interest in computer engineering, which I hadn’t had before, and found out how investing works, not only for cryptocurrencies but also in every circumstances.”

Cryptocurrency investment allows people to trade in a decentralized system, unlike the current bank system. Currently, central banks all over the world can change the value of money by choosing how much to print, while in the cryptocurrency system, no central figure is present. No one can decide how much the “coin” is going to be, unless the amount being traded changes by voluntary investment. Exchanges are made between two parties in the cryptocurrency system, via the Internet, and helps save the transfer cost that people usually pay to banks or other third parties. This also implies that trade between different countries will be much easier and efficient, due to the absence of an exchange rate. On top of this, every single trade between anyone involved in the system is written down on a trade list, which is open for all to see. This will in turn prevent people from stealing or committing fraud by using the system.

Even though there are many doubts about the fragile system of cryptocurrency, things are starting to change for the better. “As the people who ‘disposed’ and were not ‘investing’ in cryptocurrencies started to die out, the ups and downs of the stock market have started to settle down,” Analyst Kim Yeol-mae stated. However, the downsides of these should also be taken into account, just like the nature of everything else.

The Cons of Cryptocurrency

Cryptocurrency is a new type of money, which is not controlled by central banks and has a virtually unlimited supply. At some point, its impact may surpass quantitative easing, creating an inflationary pressure and eventually leading to hyperinflation.

“There has been a long debatebetween currency and commodity. In 1971, President Richard Nixon of the United States decided not to change the dollar for gold. Currently, money is issued by the government, meaning that only the central bank possesses the issuing authority. This type of money, which is still in use, is called ‘credit money’. However, in the present state system, it is very unlikely that cryptocurrency will completely take a role as the medium of exchange,”said Woo Suk-hoon, a political economist. “Still, if people continue to invest in cryptocurrency, it might have a transaction value as if it were gift certificates. Money and gift certificates sometimes have complementary functions with each other. But now, cryptocurrency has become too volatile to be used as a gift card, especially when you see it from the view of a shop owner. It is highly valued when its worth goes up, but what if it comes down? He or she might be afraid to receive it. If the currency is stable, then the gift certificate function can be effectuated. In that case, however, there would be no large scale speculation nor enthusiasts,” he added. There are several concerns about the deflation caused by cryptocurrency. Bitcoin, one of the most well-known cryptocurrencies, was designed not to exceed 21 million BTC, to prevent inflation. However, the yield of Bitcoin has risen to 16.8 million BTC, exceeding almost 80 percent of the total reserves. This means that there is a risk of deflation. Deflation caused by cryptocurrencies is even more dangerous because it is difficult for the government and the central bank to control them due to their unique features. If deflation occurs, the burden of debt repayment will increase as the rise of effective rate and the sale of assets would increase. If the sale of assets increases, the price of assets naturally fall, which in turn lead to a vicious cycle. In this process, bankruptcy of enterprises could increase, overall business activity would be stagnant, production would be reduced, and unemployment, most probably, would increase as well.

Mining currencies requires a lot of power. Miners use computers to calculate the algorithms, but the amount of accurate calculations by a single computer is fairly low. This is the starting point for cryptocurrency farms. These are basically concentrations of computers that calculate the movements of currencies at all times. The amount of power drawn from this is massive, which in turn generates enormous amounts of pollution. Bitcoin uses about 32 terawatts of energy every year, enough to power about three million U.S. households, according to the Bitcoin Energy Consumption Index published by Digiconomist, a website that focuses on digital currencies. More worryingly, Bitcoin’s energy demands are set to explode. As Bitcoin grows, the calculations that computers have to do to make Bitcoins are becoming harder, which means higher processing power is needed. A startling forecast made by Eric Holthaus, a meteorologist, states that,

“Without a significant change in how transactions are processed, Bitcoin could consume enough electricity to power the U.S. by the middle of 2019. Six months later, that demand could equal the world’s power consumption.”

The rise of cryptocurrencies is a godsend for criminals. Laundering money through cryptocurrencies is an easy process: numbers of transactions can be made easily and tracking the original money is nearly impossible. As cryptocurrencies can be used anywhere, they are hard to trace, and can be used on what is commonly referred to as the deep net or the dark web. This section of the web is unavailable for most users and is where the majority of illegal trafficking purchases take place; drugs, weapons and so on.

Actions and Perspectives People Should Take

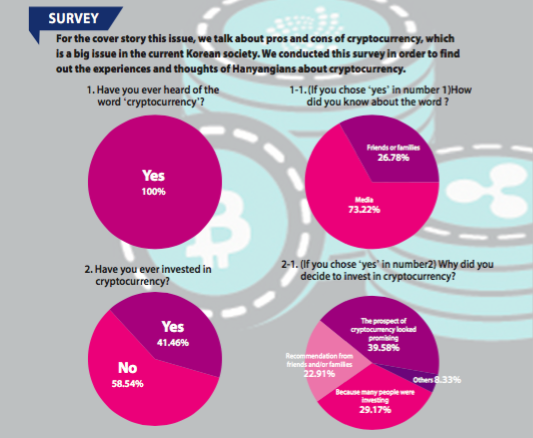

Every person is in a different situation. Some might have known about the existence of cryptocurrency in advance and may have taken advantage of it, and some might just be starting to study cryptocurrency for future profit.

However, those who are blindly planning to invest in them tend to move toward speculation rather than investment. “Speculation always rises. Some are very addictive, and in such cases, the government governs them. However, even if the stock has strong and addictive elements, the government might leave it as a part of it. They do not interfere with everything. Cryptocurrency has been in a market that has never been identified in any of the black markets or institutional markets,” said Woo Suk- hoon, the political economist.

Another negative view of cryptocurrency is that it is the 21st century version of the “Tulip Bubble”, which is considered the most severe bubble phenomenon in history. There are quite a few people who criticize cryptocurrency as fraudulent even though they cannot see that cryptocurrency will suddenly disappear like a bubble. People are just waiting and watching to see how this situation will turn out.

This can be viewed in a completely different way, too. While the tulip bubble was merely a bubble phenomenon without realistic foundation, the cryptocurrency economy is the result of a software produced by professional developers, solid cryptography, and a blockchain network involving thousandsof individuals, exchanges and retail stores. Because it is based on the real economy connected to the payment system, cryptocurrency is difficult to dismiss. If you remember the Dot- com bubble of the early 2000s, nascent businesses like PayPal, eBay, Amazon, Google and Facebook have grown since the dot-com bubble exploded. Once again, there would be an emergence of a whole new economic realm.

It is now possible to lead the global economy with a new economic model, without being bounded by the size of the territory, the number of people, or national power. Whether you choose to experience and take advantage of cryptocurrency or not, your choice should definitely be an informed one.